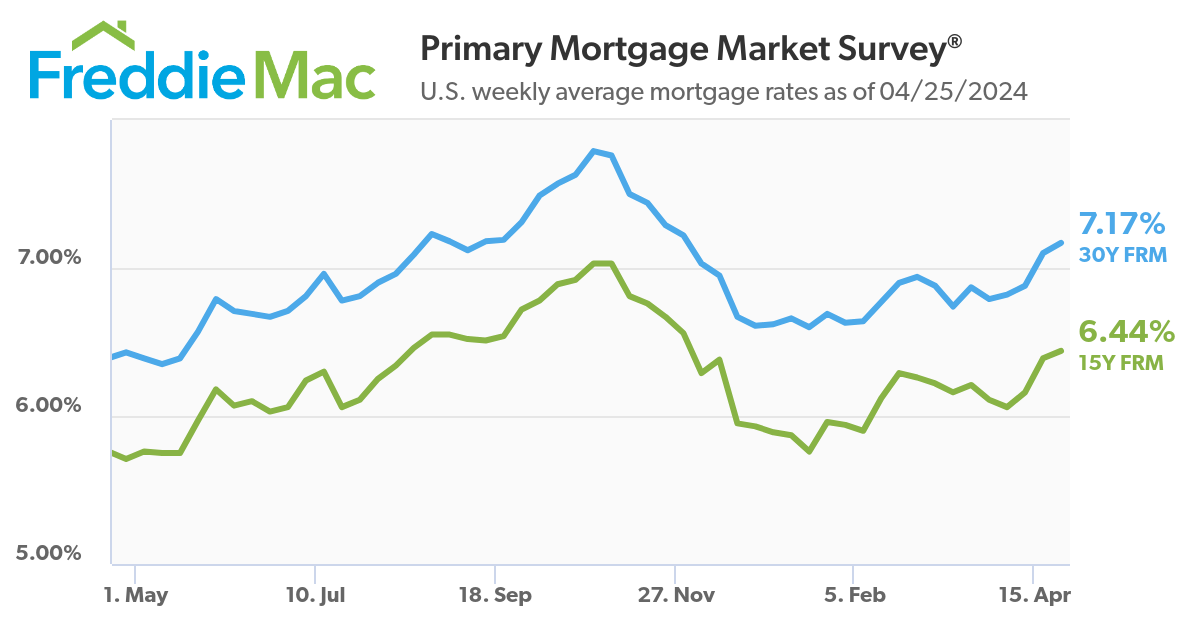

Mortgage interest rates have gone up to over 7%, which is higher than last year’s rate of below 6.5%. This is not good news for the housing market.

Mortgage Interest Rates Keep Running Higher

What You Need to Know About the Interest Rate for April 2024

Below are the latest interest rates for popular home loans based on the figures of April 26, 2024:

- 30-year fixed: 7.73%.

- 15-year-fixed: 6.94%.

- 30-year fixed jumbo: 7.69%.

Despite rates increasing more than half a percent since the first week of the year, purchase demand remains steady. With rates staying higher for longer, many homebuyers are adjusting, as evidenced by this week’s report that sales of newly built homes saw the biggest increase since December 2022.

The Mortgage interest rates continue to ascend.

What Are The Factors That Impact Interest Rates?

Federal Reserve monetary policy

The nation’s central bank doesn’t set interest rates, but when it adjusts the federal funds rate, mortgages tend to go in the same direction.

Inflation

Mortgage rates tend to increase during high inflation. Lenders usually set higher interest rates on loans to compensate for the loss of purchasing power.

The bond market

Mortgage lenders set fixed interest rates, such as those for fixed-rate mortgages, based on bond rates. These bonds, known as mortgage-backed securities, are groups of mortgages that are sold to investors and are closely linked to the 10-Year Treasury rate. When the interest rates on these bonds are high, the bonds become less valuable in the market where investors trade them. This decrease in value causes the mortgage interest rates to increase.

Geopolitical events

World events, such as elections, pandemics or economic crises, can also affect home loan rates, particularly when global financial markets face uncertainty.

Other economic factors

The bond market, employment data, investor confidence and housing market trends, such as supply and demand, can also affect the direction of mortgage rates.

2 Keys Factors That Impact Interest Rates

What do you expect the 2024 interest rates to be?

Most housing market experts predict rates will move toward 6% by the end of 2024.

“We are expecting mortgage rates to fall to around 6.5% by the end of this year, but there’s still a lot of volatility I think we might see,” said Daryl Fairweather, chief economist at Redfin.

Every month brings a new set of inflation and labor data that can change how investors and the market respond and what direction mortgage rates go, said Odeta Kushi, deputy chief economist at First American Financial Corporation.

Expert tips for the best mortgage interest rates

Save for a bigger down payment

Though a 20% down payment isn’t required, a larger upfront payment means taking out a smaller mortgage, which will help you save on interest.

Boost your credit score

You can qualify for a conventional mortgage with a 620 credit score, but a higher score of at least 740 will get you better rates.

Pay off debt

Experts recommend a debt-to-income ratio of 36% or less to help you qualify for the best rates. Not carrying other debt will put you in a better position to handle your monthly payments.

Research loans and assistance:

Government-sponsored loans have more flexible borrowing requirements than conventional loans. Some government-sponsored or private programs can also help with your down payment and closing costs.

An advertised rate isn’t always the rate you’ll get. When shopping for a new mortgage, it’s important to compare not just mortgage rates but also closing costs and any other fees associated with the loan. Contact us to get more information before getting a mortgage.