Latest news

The truth about Escalating Inflation and The Housing Market

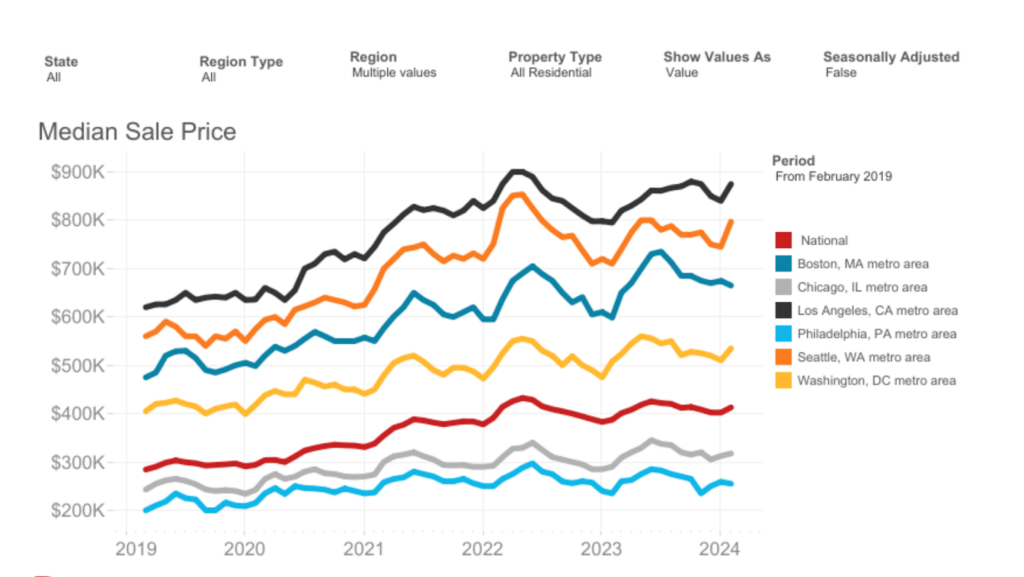

Looking forward, the California housing market is expected to remain competitive, especially for well-priced and well-located homes. Explore U.S. Housing Market Trends: Increasing Inventory and Prices Now According to Redfin.com,…

Interest Rates Update 04/2024: What You Need To Know For Investing

Mortgage interest rates have gone up to over 7%, which is higher than last year’s rate of below 6.5%. This is not good news for the housing market. Mortgage Interest…

Can I Borrow A Loan Without a Social Security Number?

Yes, you can qualify for a mortgage loan even if you don’t have a Social Security Number (SSN). Contact us today to get a Free Consultant! Applying for a mortgage…

Boost Your Decision in the Housing Market with Ease Now

Experts predict no major rise in housing market supply until mortgage rates hit below 5%. This is expected to happen after 2024. Making right decisions in the housing market easily…

Update Interest Rates changes, Empower Your Strategy Now – March 2024

The average interest rates for March ranges from 6.18% to 6.82%, a significant decrease compared to the last few months of 2023. Have you made any plans for borrowing yet?…

Secrets to beat the nightmare of Mortgage Rates for Renter

Owning a home means investing in your future, despite mortgage rates. The housing market offers more than just a place to live; it provides financial growth. https://youtu.be/ghQpu_9s5cw?feature=shared High mortgage rates…

Loan officer’s BEST ADVICES on how to buy the first home

Explore key advice from loan officers on buying your first home, covering budgeting, mortgage choices, and long-term planning. https://www.youtube.com/watch?v=qWpUlLfyyHI Who is a Loan Officer? A loan officer helps you when…

The Best Time To Enter Housing Market for Buyers

In the housing market, timing is vital. Certainly, entering at the right moment can mean significant financial gains. Conversely, poor timing can lead to limited options. https://youtu.be/-0aqk9qdcY8 Timing is vital…

To get the best deal – please refer them

Mortgage Points Mortgage points, called discount points, could be known as a one-time fee that you can opt to pay to get a lower interest rate.You can get a lower…

APR – To make decision easily with this tool

The definition of APR Annual Percentage Rate: you can call it as the cost of your total loan credit calculated into an annual interest rate. It calculates what percentage of…

Why do you think Mortgage Insurance is important?

The basic understanding of Mortgage Insurance Mortgage insurance is an insurance policy that protect a lender in some cases. For example, the borrower defaults on payments, passes away. Or he…

To be successful for getting pre-qualifications

Don’t pay off all your debts suddenly.Don’t apply for new credit cards. You can get pre-qualification easily after getting pre-approval and the process of your loan progresses to pull a…